Chapter 1 from Lessons From Prison, was written while I was serving my sentence at Taft Federal Prison Camp. I reflect on those first days in federal prison and the choices that led me to prison.

Table of Contents

Chapter Summary

Looking back, I don’t think about prison. I think about how long I ignored what I already knew. I wasn’t raised without discipline. I understood the rules. I just decided they didn’t apply when they slowed me down. That thinking didn’t start in prison. It showed up years earlier, quietly, and stuck around.

If you’re under investigation or waiting for sentencing, you may recognize some of this. You tell yourself everything is under control. You work more. You eat worse. You sleep less. You avoid hard conversations. From the outside, you look productive. Inside, you know you’re hiding.

If you’re in crisis now, use this chapter as a way to look at your own timeline. Where did you start saying, “I’ll deal with this later”? Where did you stop telling the truth, especially to yourself? You can’t change the past, but you can own the decisions that led to it.

Register for our Tuesday federal sentencing and prison webinar: Join Webinar

Also, grab a copy of our new book, 14 Costly Errors Leading to Longer Sentences.

TL;DR

- This chapter shows how prison wasn’t the starting point—it was the result of years of small compromises, ignored warning signs, and rationalized decisions.

- It helps readers identify where they may be lying to themselves, staying “busy,” or avoiding hard truths while under investigation or awaiting sentencing.

- The story illustrates how early success and external validation can make it easier to justify cutting corners and harder to admit mistakes.

- Readers see how the most painful part of the process often comes before prison—during denial, uncertainty, and avoidance.

- The takeaway is practical: you can’t change what’s already happened, but you can take ownership of the choices that led here and start correcting them now.

The Beginning

Twelve months in prison helped recalibrate my life. I certainly didn’t expect that I would grow from the experience. Yet those anxieties that plagued me during the three years that preceded my confinement were by far the worst part of my journey through the criminal justice system. Like many of the other white-collar offenders I met at Taft’s Federal Prison Camp, I simply didn’t know all the ways that prison could empower and change my life for the better.

From the beginning, I missed my family, my community, and my dog, Honey. Understandably, those feelings would stay with me through the term. In time, however, I developed routines that helped me feel productive and brought meaning to my life. Instead of struggling with the bad decisions I made that led to my troubles with the law, I spent many hours reflecting, deep in introspection. By figuring out where I had fallen off track, I could take corrective actions.

Clearly, my background suggested much brighter prospects than a stint in federal prison.

My name is Justin Paperny. When I self-surrendered to Taft Prison Camp on 28 April 2008, I was 33-years-old. My parents, Tallie and Bernie, had reared my brother Todd and me in the affluent community of Encino, in the heart of Los Angeles’ San Fernando Valley.

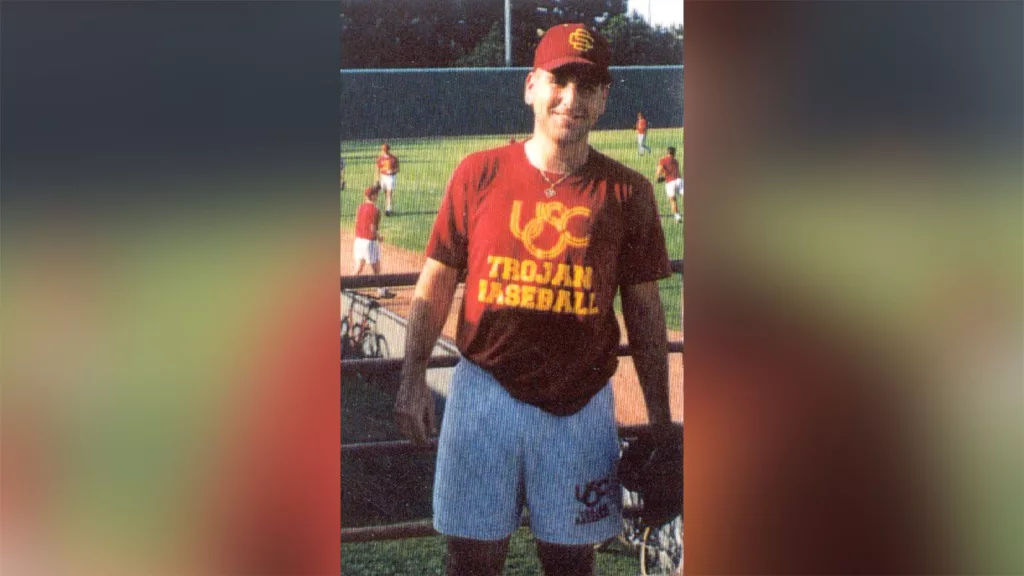

Like most American boys, as a youngster I fell in love with baseball. I had a natural gift for the sport, as if I were born with a fielder’s glove on my hand. I developed a powerful build as a youngster, and my strength led to many homeruns. I played on all-star teams from the time I turned seven, and during the course of my athletic career, I was fortunate to play in three separate World Series tournaments.

Through baseball, I learned virtues that should have stayed with me throughout life. Good sportsmanship meant loyalty, discipline, integrity, and a sense of balance. It was my childhood coach, Jack Gilardi, who really taught me the importance of such concepts. As a child and young man, those qualities or character traits were integral to my life. They led to my earning distinctions that brought a sense of pride to my parents. Through my success on the baseball diamond, I was invited to attend the prestigious Montclair Preparatory School in Van Nuys. By the time I graduated, I held several records in the Babe Ruth World Series. Those accomplishments led to scholarship offers from some of America’s best universities. I chose the University of Southern California.

While playing baseball for USC, I realized that I was no longer in the top tier among athletes. I had been a standout from the time I was six-years-old, though I reached my peak performance as a high school player. The teammates around me were continuing to develop, whereas I had kind of stagnated. At USC, under the outstanding coaching of Mike Gillespie, I worked as hard as I possibly could. Yet I was forced to accept that my unexceptional performance on a team that included many world-class athletes would limit me to a supporting rather than a starring role.

Many players whom I had known since childhood would advance to sterling careers in the major leagues. My closest friend, Brad Fullmer, was drafted by the Montreal Expos after graduation from Montclair Prep. He was one of the very few athletes who homered during his first at bat in the big leagues. Later, Brad was a major contributor to the Anaheim Angels during their 2002 World Series victory.

Other friends of mine, who built successful careers in the big leagues, included Jeff Suppan, Aaron Boone, Gabe Alvarez, and Geoff Jenkins. I knew that my baseball career would end at USC.

I was in my early 20s, and I understood that without sports I would have to find another way to earn a living. My father owned a hardware store that had been in the family for three generations. My brother Todd, however, who was studying at UCLA, expressed more interest in carrying on the family business. I had to find something else.

Through a friend of my mother’s, I became intrigued with the brokerage business. I was majoring in psychology at USC. When I told my mother that I was thinking about becoming a stockbroker, she stepped up to help. That was Tallie’s way. She was a wonderful mother, and never missed an opportunity to make my brother and me feel as if our success and happiness were the highest values of her life.

“I have to call your cousin, Richard Levy,” she said. “He’s highly educated and newspapers have reported him as being one of the most successful brokers on Wall Street.”

I’d never met this cousin, yet my mother felt certain he would usher me into the elite world of high finance. Richard, on the other hand, who was a star at Bear Stearns, was underwhelmed with the plea for intervention from my mother. He was based in New York, and he didn’t have the time to tutor a distant cousin who wasn’t even studying in the Ivy Leagues.

“Why don’t you call Todd Goodman,” Richard suggested. “Todd’s right there in Los Angeles. He should have no problem helping your son get started.”

Todd Goodman was another cousin of mine, and he was a money-management legend in his own right. Todd would become the founder of Goodman Investments but at the time my mom called him he was a lead performer in the Los Angeles office of Goldman Sachs. She pleaded with Todd to give me a break. “Have him here by four tomorrow morning. And tell him to wear a suit and tie.”

I was on summer break between my junior and senior year when my mom orchestrated my interview with Todd. Although we had never met previously, I knew of his and his brother Jeff’s success. Both were partners at Goldman Sachs, and they managed portfolios for some of the biggest names in the entertainment business. When I presented myself to the Goldman Sachs offices at four in the morning, I didn’t know what to expect. I found a room bristling with energy and alive with action. Todd stood at the heart of it all.

“So, you’re the baseball player,” Todd said as he sized me up. “Where do you plan on going to business school?”

“I’m not planning on getting an MBA,” I answered. “I want to learn about the brokerage business.”

Todd wasn’t impressed. “What do you mean, you’re not going to business school? You’ve got to get an MBA.”

“I want to be a stockbroker, not an investment banker.”

Todd looked at me as if I were a child complaining about school. “A stockbroker’s nothing more than a salesman. Maybe you should just sell cars.”

“Can’t I just learn about stocks from you for a while?”

“What do you want to do?”

“I want to watch you work, to learn about the business a little.”

“Okay,” Todd told me. “You can watch.”

I wouldn’t exactly call my time at Goldman Sachs an internship. Still, my time with Todd certainly convinced me that I wanted to build a career as a stockbroker. I loved the excitement. I sat in the trading room listening to the lingo and feeling myself infected with the adrenaline rush. I watched men screaming orders that had values in the tens of millions into the telephone. Although I didn’t do much more than pour coffee and lick envelopes, I felt the same level of excitement in that room as if I were playing on a team in a stadium with 20,000 screaming baseball fans and national television was broadcasting the game.

On the advice of Todd, I interned at a few other brokerage houses while I was finishing up my final year at USC. Those efforts paid off. By networking in the industry, I had a few job offers waiting for me once I had my degree in hand. Although Todd’s influence helped me secure an interview with Goldman in New York, I understood that was not enough. Moderately good grades and a baseball pedigree from a California school were not going to get me beyond the first round of interviews at the world’s most prestigious investment bank. As my interviewer told me in no uncertain terms, “Goldman typically hires only from the Ivies, and we only accept students of exceptional distinction.”

Within a week of graduating, I accepted a job offer to work at Merrill Lynch in Orange County. In order to ensure that I could make it to the office before five each morning, I moved 60 miles south. By the second day I felt miserable. I missed my girlfriend, my family, and my home.

The job required that I stay in the office from well before dawn until after nine each evening. The job wasn’t even fulfilling. I hadn’t yet earned my securities license so I was restricted to cold calling and sending out research materials. Other brokers referred to my tasks as paying dues. Being a team player, I felt willing and eager to give the job all I had. Within weeks, however, the pressures were wreaking havoc on my personal life.

I had graduated college in tip-top physical condition—lean and muscular. That changed quickly after I started my career as a stockbroker. The long hours left zero time for exercise. During the day, I would chow down the catered meals brought into the brokerage house. When I finished in the evening, I gorged myself with more pizza, burgers, or burritos from fast food restaurants. Within months, my weight had ballooned by 30 pounds, none of it muscle.

“You could lose 15 pounds just in your cheeks,” my girlfriend would tease during my weekend trips home.

“What the hell are you doing down there?” My friend, Brad, would look at me with astonishment. Health magazines had given him cover shots as baseball’s most fit athlete. “You’ve only been out of college for a few months, and you already look like an old man. I don’t know what’s going on down in O.C., but you need to mix in a salad once in a while. It’s time to boycott In-and-Out.”

They were right. I was working myself to death and I felt miserable. I studied for my Series Seven exam with the appropriate agency for securities professionals, and I earned my license a few months later.

Once I had my license in hand, I learned the truth about the brokerage business. It was cut throat. Unlike my experience as a baseball player, where men of good character and fairness surrounded me, in the brokerage business I was living amidst deceit, greed, and questionable ethics.

I was only 23-years-old when my supposed sponsoring partners at Merrill Lynch shafted me for commissions to which I was rightfully entitled. From that treachery, I learned that I would have to play by a new set of rules to make it as a broker.

I left Merrill Lynch in anger because I felt cheated out of several thousand dollars of commissions. If neither the firm nor my colleagues would stand by me, I saw no reason to stand by loyally to them.

In retrospect, I recognize that my decision to leave Merrill was one of the first in a series of sliders. I felt my moral character deteriorating. Rather than standing up for fairness, integrity, and discipline, and the other virtues I had been groomed to follow as an athlete, I began my descent to the lowest common denominator in the brokerage business.

Instead of promoting and living by a solid code of ethics, I compromised my own values and ceased to function as a team player. I allowed myself to become influenced by the worst part of the industry, meaning that I thought about my own short-term needs rather than the greater good of the team and a winning season.

It was similar to my decision not to earn an MBA, as my cousin Todd Goodman had urged me to pursue. All of those years committing myself to baseball, I suppose, had taken a toll on my ability to focus on delayed gratification. I felt less inclined to look into the future and commit to further investment of time. I had reached my early 20s and felt ready to get paid.

Ironically, it wasn’t until I came to prison that I began to see those traits. The more than 12 months I spent locked inside the community of felons gave me the space I needed for introspection. By realizing where and how I had gone wrong, I could understand my weaknesses better. That self-awareness made a difference in my adjustment. It gave me better direction for the rest of my life.

FAQ

What is Chapter 1 of Lessons From Prison about?

It’s about how I grew up, went into brokerage, and slowly drifted away from the values I started with, long before I got to Taft.

Why start the book before prison instead of at the gate?

Because most defendants don’t “suddenly” end up in prison. It builds over years. I wanted to show that honestly.

How does this chapter help someone facing a federal case?

It helps you see where you might be lying to yourself or pretending things are normal when they’re not.

Does Chapter 1 talk much about daily prison life?

Not yet. It sets the stage—who I was, what shaped me, and how I moved into a career that made it easier to compromise.

Why do I talk about baseball and my early success?

To show the contrast. I didn’t grow up planning to break the law. I slowly let other priorities matter more than character.

What should a defendant pay attention to in this chapter?

Notice the excuses. Notice where I started caring more about money, status, and speed than patience and fairness.

How can a family member use this chapter?

They can use it to better understand how someone they love could end up in trouble without being “a criminal” from the start.

Top Misconceptions

Misconception: A white-collar case is one sudden fall from grace.

Correction: For most of us, it’s a series of small choices we ignore until it’s too late.

Misconception: The first days in federal prison are pure chaos.

Correction: In a camp, they’re often quiet and confusing more than chaotic. You have time and space to think.

Misconception: Your past success protects you once you’re in prison.

Correction: Staff and other people in custody don’t care how much you made or who you represented.

Misconception: You can wait to “deal with it” until after sentencing.

Correction: Waiting usually makes things worse. The earlier you start being honest and building a plan, the better.

“If You’re Facing A Federal Investigation Or Prison…”

If you’re reading this because you’re in trouble, here’s what to pay attention to in Chapter 1:

- How easy it was for me to justify small compromises.

- How long I wasted time excusing instead of introspecting

- How success made it harder for me to admit I was wrong.

- How the change started when I stopped blaming everyone else.

- How the first days in federal prison gave me time to finally look at the full picture.